|

In a recent analytical paper

Russia's Natural Gas Dilemma (full text with links is

available here), Stratfor claims that Gazprom is losing money on

its domestic sales. This statement is a way outdated. According to

the financial reports of Gazprom, the domestic sales are profitable

from 2004. The important swing from loss to profit was also

mentioned in the company's 2003 annual report (see

page 64).

After two profitable years, Gazprom's

top management has decided that all gas produced at the highest cost

goes to Russian consumers and this simple accounting trick has

created a loss in 2007.

As explained to the shareholders, "stripped gas bought from our

daughter companies is much more expensive than natural gas and the

stripped gas is being delivered exclusively to Russian consumers".

It is worth noting, that in an

arbitration trial in

2002, Gazprom has proved that all stripped gas goes for export

sales (at that time exports of this product were free of customs

duties). In 2008-2011, Gazprom reported profits from the domestic

sales. Gazprom sells gas at the state-regulated wholesale price that

is above the delivery cost in all regions of West Siberia and

European Russia. The article wrongly assumes that Gazprom sells gas

to the end-users. There are no dumping prices of gas in Russia.

As a matter of fact, the low end-use

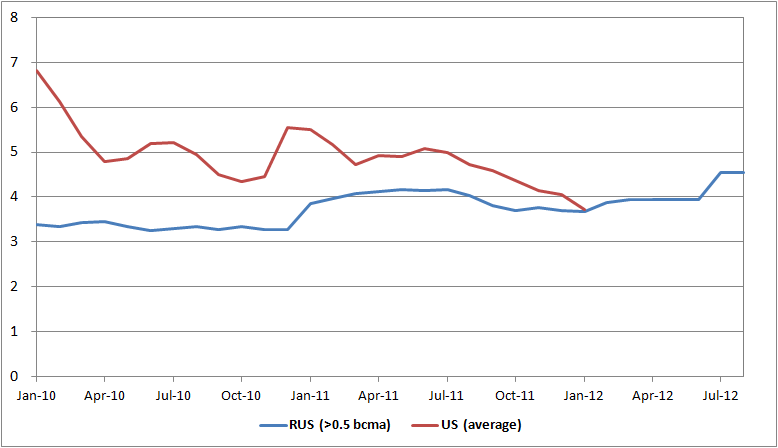

price of natural gas in Russia is a myth. In January 2012, the

average price of natural gas used by the

US power plants has reached parity with the price paid by major

power plants in Russia that consume over 0.5 bcm/year or over 50

mmcf/day (see the chart below). Moreover, the average price of gas

in Ohio ($3.00/MMBtu) and Pennsylvania ($3.49/MMBtu) is much lower

than the price paid by power plants in Central European Russia. Note

that power

sector represents 30% of the total domestic sales of the Russian

gas giant.

Figure

1. End-use price of natural gas in the power sector of the US and

Russia, USD/MMBtu

Sources: EIA; RF Federal

Tariff Service.

On July 1, 2012, the price for

non-residential consumers will be raised by 15%. The Russian price

for May-August 2012 is our forecast based on the current exchange

rate of the Russian ruble.

It is worth noting that Gazprom is the

least taxed company in the Russian oil-and-gas sector. In 2011,

Russia produced more natural gas than oil in terms of oil

equivalent. However, the total gas production tax collection ($4.6

Bn) was just a fraction of that of oil production tax ($62.9 Bn). In

the period of growing export prices, the Russian government was

steadily reducing the share of

export duties in the export revenue of Gazprom.

According to the Russian government,

the end-use price of gas for non-residential consumers should be at

least twice higher than now. If the price goes that high, Russia is

very likely to start importing fertilizers, cement and other natural

gas-intensive products from the USA. The real dilemma is about that.

Mikhail Korchemkin

East European Gas

Analysis

Malvern, PA, USA

April

23, 2012

P.S. The author has provided

consulting services in anti-dumping cases against Russian companies.

Reproduction or use of

materials is allowed only with reference to East European Gas

Analysis or www.eegas.com

|