|

Gazprom

pipelines and export capacity

Газопроводы Газпрома и экспортные мощности

Gas pipelines of West Siberia

Газопроводы Западной Сибири

Export flows of Gazprom

Экспортные потоки

Spot, Gazprom, Brent

Цены на нефть и

газ

End-use price of gas

Russia and USA

Daily gas production

Суточная добыча

| |

Important Changes in Russian Gas

Business Environment

-

Quarterly financial reports of Gazprom show

significant overpayment of export duties

-

For the period from January 2004 to May 2005,

we estimate the total overpayment at $1.3 billion

-

Currently Gazprom is losing about $3 million a

day of export duties

-

Before January 2004, Gazprom exports to Europe

and the former Soviet Union (except Belarus and Kazakhstan) were subject to

the following principal taxes:

-

On January 1, 2004, excise tax was annulled and

the export duty rate was raised to 30%:

-

Gazprom started to pay export duty on the cost

of transit out of Russia

-

According to Q3-2004 financial report of

Gazprom, this change has caused tax growth of $550 million

-

Gazprom could have avoided the additional

taxation

-

We do understand that it is an extremely hard

time for tax optimization in Russia now

-

However, paying tax on transit cost is

absolutely wrong

|

|

Sample Net Revenue from Gas Exports to Waidhaus,

USD/mcm |

Map of the Area |

|

|

Before |

After

01.01.2004 |

|

|

01.01.2004

|

Actual

|

Optimal |

|

Price at Waidhaus, German border |

150.00 |

150.00 |

150.00 |

|

Export (customs)

duty |

7.50 |

45.00 |

- |

|

Transit cost from Kursk to Waidhaus |

30.00 |

30.00 |

30.00 |

|

Excise tax base |

112.50 |

- |

- |

|

Excise tax |

33.75 |

- |

- |

|

Export duty tax base |

- |

- |

120.00 |

|

Export duty at point of sale Kursk, Russian border |

- |

- |

36.00 |

|

Net revenue at Kursk |

78.75 |

75.00 |

84.00 |

|

Loss |

- |

- |

9.00 |

Optimal case assumes the move of point of sale from Waidhaus to Kursk

or change of definition of taxation base. |

|

(A) Filing application for a change of

definition of taxation base

-

Customs Code of the Russian Federation allows

the use of alternative ways for calculation of taxation base of export duty

-

Gazprom should have filed the application on

the first business day of January 2004 (it would have made the overpayment

refundable)

-

The regulation is very likely to be changed

because options (B) and (C) show that Gazprom is not to pay tax on transit

cost anyway (though Gazprom's application with documented

alternative options is

required first)

(B) Changing contract terms with all importers

-

Moving the point of sale to the Russian border

and cutting the price by the cost of transit

-

Dividing the payment gas volumes between the

relevant importers

-

Importers would pay transit costs either by

gas or cash

-

Benefits of this option are smaller than

in (A) because importers would need a price discount

(C) Creating a 100% daughter company

out of Russia and Belarus (for instance, Gazexport-Ukraine)

-

Selling all export gas at the Russian border

to Gazexport-Ukraine at the price reduced by the cost of transit

-

Selling gas to all importers at the existing

terms

-

Showing no profit in Ukraine

-

This option is economically better than

(B), though benefits are smaller than in (A) because Gazexport-Ukraine

would have some expenses and taxes in Ukraine

(D) Setting up a private foreign company that would

buy all export gas at the Russian border and sell it to importers

-

Gazprom and the new company would split the

saved export duty (about $3 million per day in 2005)

-

In recent history of Gazprom, companies like

Itera and Eural Trans Gas have benefited from helping Gazprom to reduce tax

payment

-

It is a nice way of making new legal

multi-millionaires or a billionaire

-

It would be a bigger and a way more

transparent business than Baikal Finance Group, that bought Yuganskneftegaz

-

This business would end with the change of tax

regulation, so Kremlinís cooperation is a must

-

There are no legal obstacles to stopping the

overpayment

-

Gazprom is using third parties for tax

reduction for years

-

RosUkrEnergo buys Central Asian gas in

Kazakhstan and exports it out of Russia

-

It saves Gazprom about $0.8bn a year of export

duty

-

If RosUkrEnergo scheme is legal, then

Gazexport-Ukraine (option C above) is absolutely safe

-

Itís hard to believe the management of Gazprom does not see the

overpayment problem

-

From January 2004 through May 2005, management inaction has caused a

loss of about $1.3bn

-

Every day Gazprom loses another $3 million

-

Gazpromís Charter still says the Companyís

goal is to make profit

-

For the state, $13 billion tax collection from

Gazprom is a way more important than $0.3 billion dividends it received as

shareholder in 2004

-

Is Gazprom changing back into ministry?

-

The missed opportunity to increase Gazpromís

cash flow by $1.3bn has negative side effects

-

Gazprom had to take additional loans, which

resulted in additional financial costs

-

Market capitalization of Gazprom could have

been much higher

-

The 2004 profit could have been higher and

shareholders got lower dividends

-

It is not all positive for the state neither

-

To fill the financial gap, Gazprom lobbies

increase of the domestic price of gas

-

It results in higher inflation in Russia, as

well as in lower competitiveness of all Russian businesses, including

Gazprom

|

-

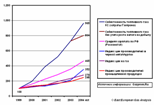

Gazprom has turned into a classic textbook

monopoly that has no reason for cost control

-

The chart compares the growth of Gazprom costs

with industrial price and wage indices of Russia in 1999-2004

-

We use the reported cost of fuel gas (gas

burned at compressor stations of transmission pipelines) as an accurate

indicator of the overall cost performance of Gazprom

-

In the accounting books of Gazprom, fuel gas

is reported at delivery cost and it is not affected by sales taxes (VAT,

excise, customs duty etc)

-

On the positive side of the tax overpayment

issue, it indicates that Gazprom can easily increase its cash flow by $1bn a

year

|

|

|

|